English | 中文

Yin Gefei|ESG in the CSR era

source:goldencsr date:2021-08-23 16:39:31In the last two or three years, especially since 2021, Environmental, Social and Governance (ESG) has become a hot topic in the field of social responsibility, capital and financial market. It has brought many new forces to the field of social responsibility and sustainable development, together with many puzzles and challenges.

Will ESG report replace social responsibility report or sustainability report? Will ESG replace social responsibility?Focusing on these issues, Yin Gefei, Founder and Chief Expert of GoldenBee Consulting, Joint-secretary of of ISO 26000 Stakeholder Global Network (ISO 26000 SGN), shared his interpretation at the 16th International CSR Forum.

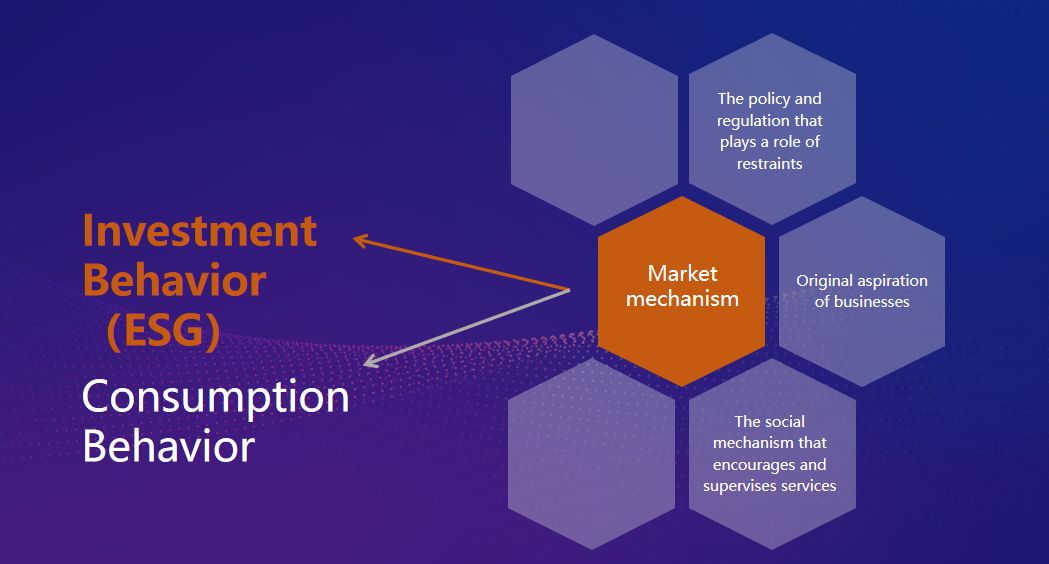

The development of social responsibility is a long-term process. There are four mechanisms for the CSR development: first, the policy and regulation that plays a role of restraints; Second, the social mechanism that encourages and supervises services; third, original aspiration of businesses; fourth, market mechanism.

Among them, the market mechanism can be divided into two parts: one is the responsible investment mechanism. ESG investment is a hot topic of responsible investment. When investors in the capital market choose investment objects or stocks, they not only look at economic performance, but also focus on non-financial factors such as environmental, social and corporate governance. The extension of this mechanism has a direct impact on the listed companies, and has also aroused great concern of listed companies for CSR.

In recent years, ESG in financial market has developed rapidly in China. Taking China's banking industry as an example, relevant government departments and regulators have been advocating E-banking (green bank) or S-banking (social loan). Green credit is the "E" in ESG, that is, environmental factors are integrated into the loan requirements to promote green development. Inclusive credit is the "S" in ESG, that is, social factors are integrated into the loan requirements, such as providing financial services for small and micro enterprises and vulnerable groups to promote the development of social equity.

The second one is responsible consumption mechanism. If every consumer does not consider the consumption and production process of the product when purchasing products, including the impact on the social environment in the process of product consumption, it is difficult for the society to produce a responsible business, because when everyone only cares about the cheap price, enterprise would try to reduce the attention on the environment, society and employees and they would cut the cost to the minimum.

ESG is an inevitable process of social responsibility development, and it is one of the market mechanisms of social responsibility development. CSR development also needs the generation of responsible consumption mechanism, and further development of ESG. In addition, it is necessary to make clear that ESG is not equal to sustainable investment. ESG investment is not a kind of sustainable investment, nor can it bring about the generation of responsible enterprise groups.

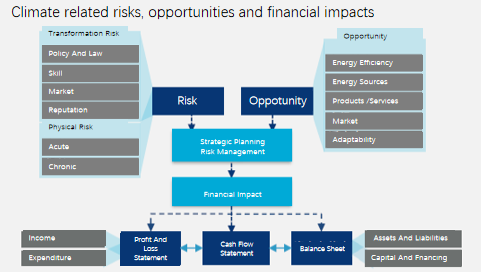

Of course, ESG will greatly promote CSR in the new era, and it will improve the awareness of CSR risks and opportunities.

For example, investors, lenders, insurance companies and other stakeholders have an increasing demand for climate related financial information to facilitate decision-making. Improving the disclosure of climate related risks and opportunities will provide investors, lenders, insurance companies and other stakeholders with the necessary indicators and information to conduct a sound and consistent analysis of the possible financial impact of climate change.

These will directly enhance corporate awareness of social responsibility risks and opportunities.

Measuring ESG in capital market or financial market can make risks and opportunities visible, and enterprise management framework become clearer. Therefore, in the capital market, when listed companies issue ESG reports according to the requirements of the exchanges, they should consider the management and control of risks and opportunities, and finally elevate them to the agenda of the management, so that social responsibility can act as a strategic consideration, and integrated into the decision-making and operation of an company.

Therefore, ESG is an important content to measure the sustainability of listed companies in the capital market, and also a tool to promote the capital market to consider long-term value investment:

◆ ESG governance level is an important reference frame for investment in listed companies

in the capital market

◆ ESG risk prevention and control capability is an important reference and warning mark for investors to hold for a long time

◆ ESG management is essentially permeated in all aspects of impact factors of an company towards the long-term operation

ESG strengthens the demand for quantification of social responsibility performance. The more clear ESG performance is displayed, the more investors will understand and favor it. The value of companies, especially the listed companies, will be correctly reflected in the capital market, and the financing cost of companies and listed companies will be reasonably expected. Both sides can get benefits and form a virtuous circle.

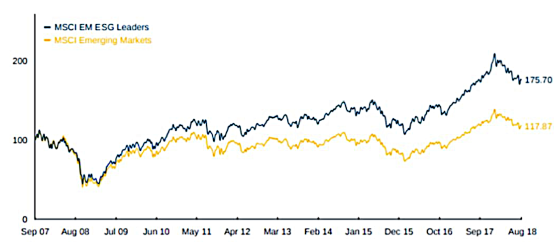

Comparison of MSCI Emerging Markets Index and MSCI Emerging Markets ESG Index

From the trend of MSCI Emerging Markets Index and MSCI Emerging Markets ESG Index from 2007 to now, we can see that ESG index is gradually better than traditional index since 2009, and the gap is gradually expanding.

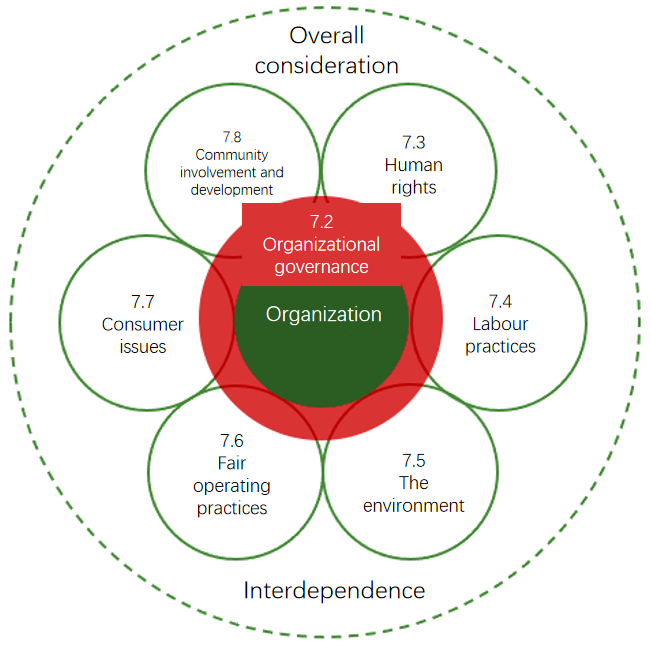

ESG also highlights the G (governance factor) in social responsibility. In fact, ESG is a relatively concentrated expression of the important non-financial factors of social responsibility, which is manifested in environmental, social, and governance. Social responsibility also attaches great importance to governance. Among the seven core subjects of ISO 26000, organizational governance has the most special position:

First, organizational governance is the core content of social responsibility, which is one of the seven core subjects of ISO 26000;

Second, organizational governance provides tools and methods for fulfilling the other six social responsibility subjects;

Thirdly, organizational governance is the guarantee for the implementation of the seven principles of social responsibility of ISO 26000;

Fourth, organizational governance is the basis for the implementation of two practices of ISO 26000, namely, identification of social responsibility and stakeholder engagement;

Fifth, organizational governance is the guarantee for the integration of social responsibility into the organization.

In the short introduction of ESG, the governance factor "G" is more prominent.

ESG makes this “G” prominent, which is reflected in the special setting of ESG leadership role and accountability system in the Guangzhou Equity Exchange, and puts forward requirements for the board of directors of listed companies. The board's responsibilities in ESG management and specific practices require ESG assessment. This system improves the importance of social responsibility for top managers of listed companies.

The development of ESG will set off an upsurge in the development of social responsibility, because there are more market forces involved and a clearer mechanism has been formed, which will make the development of social responsibility enter a new stage.